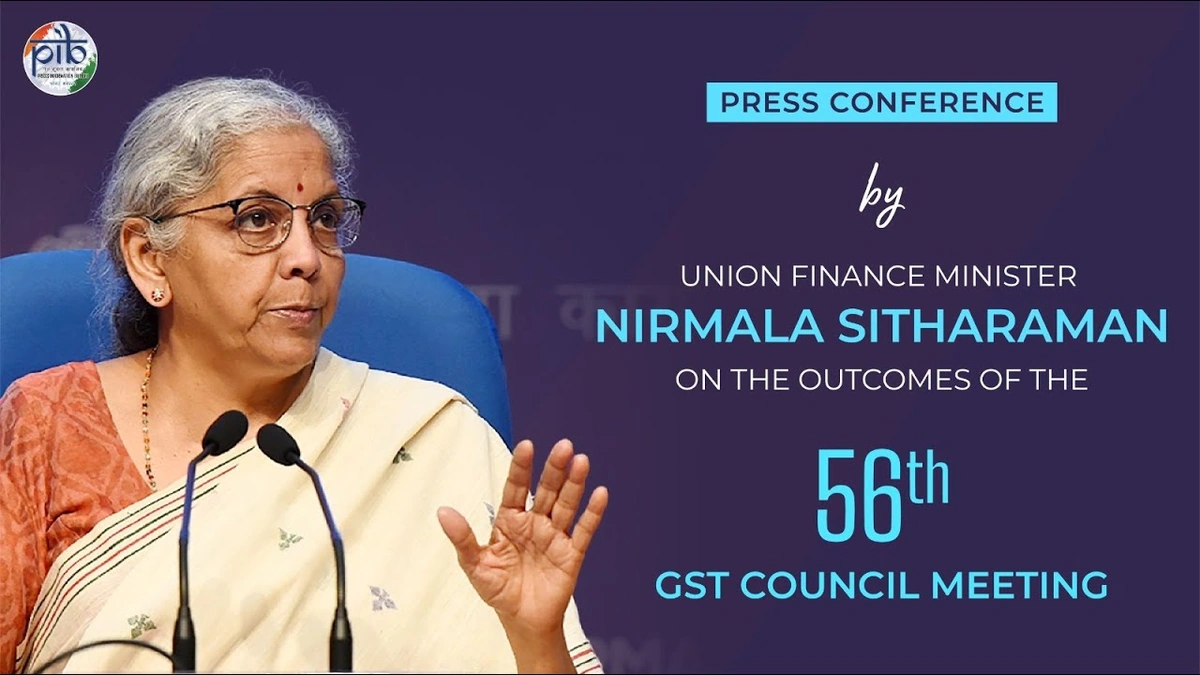

Decoding Nirmala Sitharaman’s GST Council Meeting | What It Really Means for You

Alright, let’s dive into the latest GST Council meeting , spearheaded by Nirmala Sitharaman. It’s easy to glaze over these things, thinking it’s all just numbers and jargon, but trust me, it directly impacts your wallet and how businesses operate. The big question is: what’s really going on here? I’m not just going to regurgitate the headlines. We’re digging deeper to understand the why behind the decisions.

GST Rates | More Than Just Numbers

So, what decisions were made regarding GST rates ? Often, the headlines focus on which items got cheaper or more expensive. But that’s just the surface. What fascinates me is the ripple effect. For example, a seemingly small change in the GST rate for textiles can drastically affect small businesses in Surat or Tirupur. And the government’s rationale is key. Are they trying to boost a particular sector, correct an anomaly, or simply increase revenue? Understanding the intent helps us predict future policy changes.

The way these rates are decided is also significant. What data are they using? Are they considering regional disparities? These are the questions that truly matter.

The Composition Scheme | A Lifeline for Small Businesses?

Let’s talk about the composition scheme . This is huge for small businesses – especially those just starting out. Here’s the thing: navigating the complexities of GST can be a nightmare for small-scale entrepreneurs. The composition scheme aims to simplify things, allowing them to pay a fixed percentage of their turnover as GST, instead of dealing with detailed record-keeping and filing returns.

But, (and it’s a big but) is it actually helping? Are the eligibility criteria too restrictive? Are businesses that could benefit missing out because they aren’t aware of it? Or maybe the rates aren’t low enough to truly incentivize adoption. I initially thought this was straightforward, but then I realized the devil is in the details. The success of the composition scheme hinges on its accessibility and relevance to the smallest players in our economy.

Impact of GST on Common Man

Okay, let’s be honest, most of us just want to know: how does this affect me? Changes from any nirmala sitharaman gst council meeting directly impact the common man. It’s not always obvious, but think about it. If the GST on restaurant bills changes, you’ll notice it immediately. But even changes to industrial inputs can eventually trickle down to consumer prices. Schemes and taxesare often intricately tied.

What’s fascinating is how different states react. Some might absorb some of the tax burden to protect consumers, while others might pass it on directly. And political considerations always play a role. Election years often see fewer tax increases and more populist measures. It’s a complex dance of economics and politics.

GST Compliance | Simplifying the Process

One of the biggest headaches for businesses is GST compliance . The government has been trying to streamline the process, introducing e-invoicing and simplifying return filing. But are these measures really making a difference?

A common mistake I see people make is waiting until the last minute to file their returns. The official GST portal can get overloaded, leading to errors and delays. Trust me, I’ve been there. Staying organized throughout the month and using reliable accounting software can save you a ton of stress. As per reports, new measures are constantly being evaluated by the GST council to improve ease of doing business.

Future of GST in India

Where is GST headed? That’s the million-dollar question. What fascinates me is the potential for further integration and simplification. Could we eventually move towards a single, unified GST rate across all goods and services? It seems like a pipe dream now, but it would drastically reduce complexity and improve efficiency. The governmenthas to ensure that citizens do not face any hurdle because of taxations.

However, it faces many hurdles. States are reluctant to cede too much control over their revenue, and powerful vested interests often lobby against changes that could hurt their bottom line. It’s a constant tug-of-war between economic efficiency and political realities. According to Wikipedia , tax reforms have a deep rooted history.

Ultimately, the future of GST depends on the government’s willingness to push through reforms, even in the face of resistance. It requires a delicate balancing act of consensus-building, data-driven decision-making, and a clear vision for the future.

FAQ Section

Frequently Asked Questions About Recent GST Council Decisions

What is the GST rate for electric vehicles (EVs)?

The GST rate for electric vehicles is currently set at 5%. This lower rate is intended to encourage the adoption of EVs in India.

How does the composition scheme benefit small businesses?

The composition scheme simplifies GST compliance for small businesses by allowing them to pay a fixed percentage of their turnover as GST, reducing the burden of detailed record-keeping.

What if I disagree with a GST assessment?

You have the right to appeal a GST assessment. The process typically involves filing an appeal with the appropriate appellate authority within a specified timeframe. Consult with a tax professional for guidance.

What measures are being taken to improve GST compliance?

The government is implementing measures such as e-invoicing, simplified return filing, and data analytics to improve GST compliance and reduce tax evasion.

How often does the GST Council meet?

The GST Council meets periodically, usually every few months, to review GST rates, policies, and procedures. The frequency of meetings can vary depending on the need for policy adjustments.

So, the next time you hear about a Nirmala Sitharaman GST council meeting , don’t just dismiss it as boring news. Remember that these decisions have real-world consequences, shaping our economy and impacting our daily lives. Stay informed, ask questions, and hold our leaders accountable.